Texas Employee Tax Withholding Form – The Worker Withholding Develop (W-4) is made to streamline the entire process of finding out your withholding percentage. You should utilize the W-4 form if you are single, have no dependents, and do not itemize deductions. To complete the shape, you need your own name, deal with, Interpersonal Safety number, submitting standing, and trademark. Inside the links provided below, you can get an example form. then follow the directions, making sure to sign the record once you can. Texas Employee Tax Withholding Form.

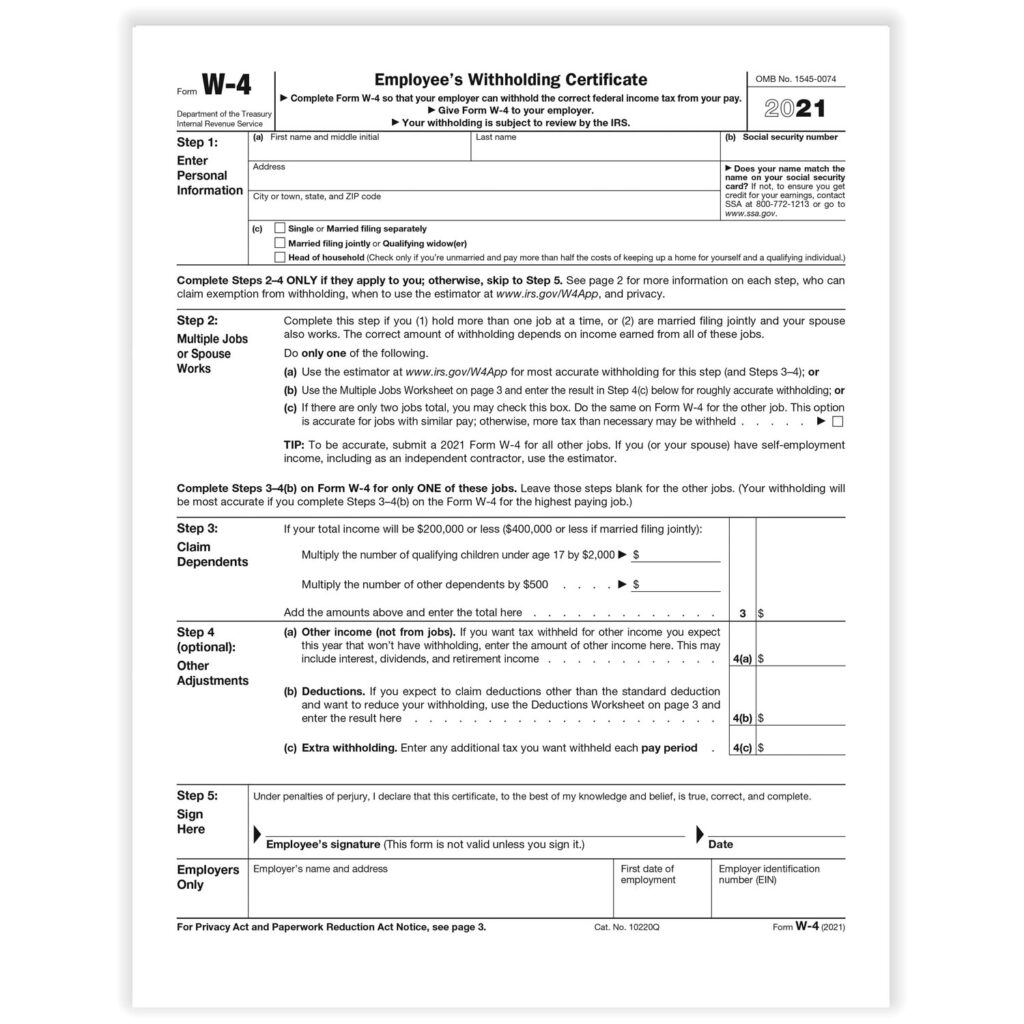

Employee’s Withholding Certification, Form W-4

The Form W-4 – Employee’s Withheld Certificate is commonly used by the employer to find out simply how much taxation ought to be deducted through your income. To protect yourself from owing too much taxation, it is vital that you complete the shape totally. Your withholding amount can also be modified at any time. However, you will have to complete a new Form W-4 if you switch employers. Before completing a new one, it is crucial to review your employer’s policies.

The Internal Revenue Service web site supplies a down load for the Type W-4. You will find five methods inside the type that need to be done. You have to enter in certain info for every move, including your Interpersonal Safety number and processing standing. When things are all filled in, you must sign the record to attest that you will be whom you say you happen to be. Once you have correctly filled out the form you will obtain a statement from the IRS. Additionally, your boss have to obtain a backup of the done Develop W-4 of your stuff.

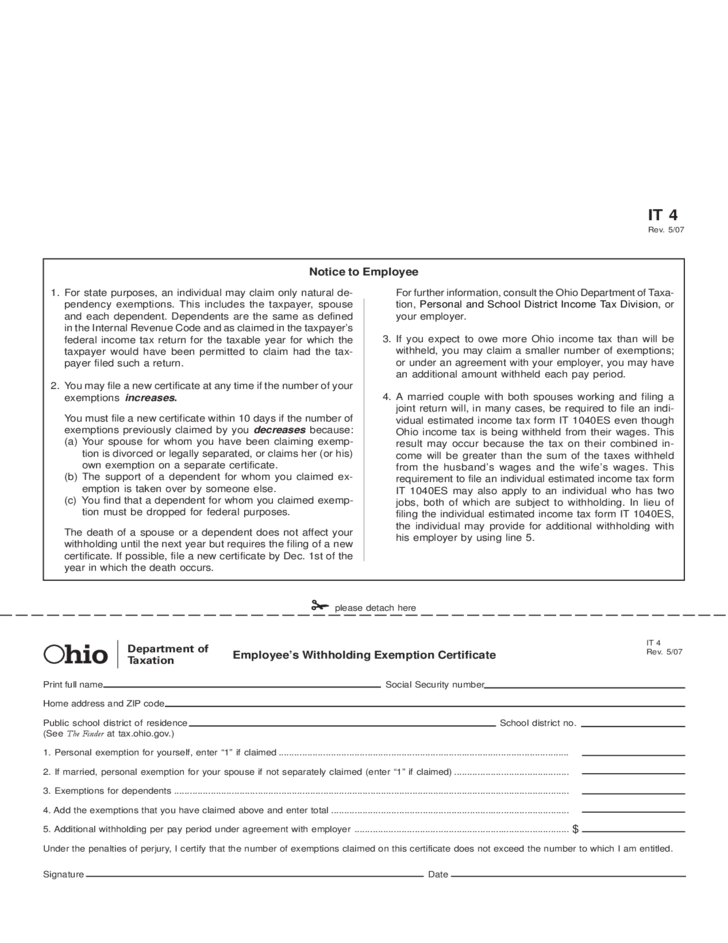

Ask for Exemption from Withholding (IT-2104)

Organisations experiencing workers under the age of 18 must submit an IT-2104 – Request for Exemption From Withholding type every year. Businesses apply it to figure out how much withholding a staff member is qualified for. The employer is required to transmit a copy of the form to the New York State Tax Department if an employee receives allowances totaling more than $14. The employer must put in the relevant line if an employee receives no allowances. Line 5 should contain the financial amount that had been extra.

The business is needed to verify that the employee has claimed all appropriate exemptions right after the employee receives a develop professing exemption. Every time a new staff is hired, an exact IT-2104 – Request Exemption from Withholding form needs to be finished. You can steer clear of a lot of tax season hassles, by doing this. There are numerous traps in order to avoid. Organisations are required to distribute personalized info on staff members, including delivery dates and handles, on the IT-2104 kind.

Allowances

The Allowances for workers Withholding Form is editable at any time, nonetheless it is advised you do so once your situations modify. Changes in life occasions, such as relationship or separation and divorce, using a child, or declaring a bankruptcy proceeding, needs to be the major reason behind altering withholding allowances. You must update your Type W-4 consequently. You may uncover out greater concerning how to make this happen by looking at Publication 55. Moreover, a number of other stuff may influence withholding allowances.

If a head of home or single taxpayer works two jobs and earns more than $107,650, he must reduce his allowances by seven, for instance. His total earnings must be below this sum if the individual works two jobs. In addition, the allowance must be cut by seven if the recipient has a higher paid employment. If the amount of allowances is negative, the amount of tax due will exceed the entire amount of allowances.

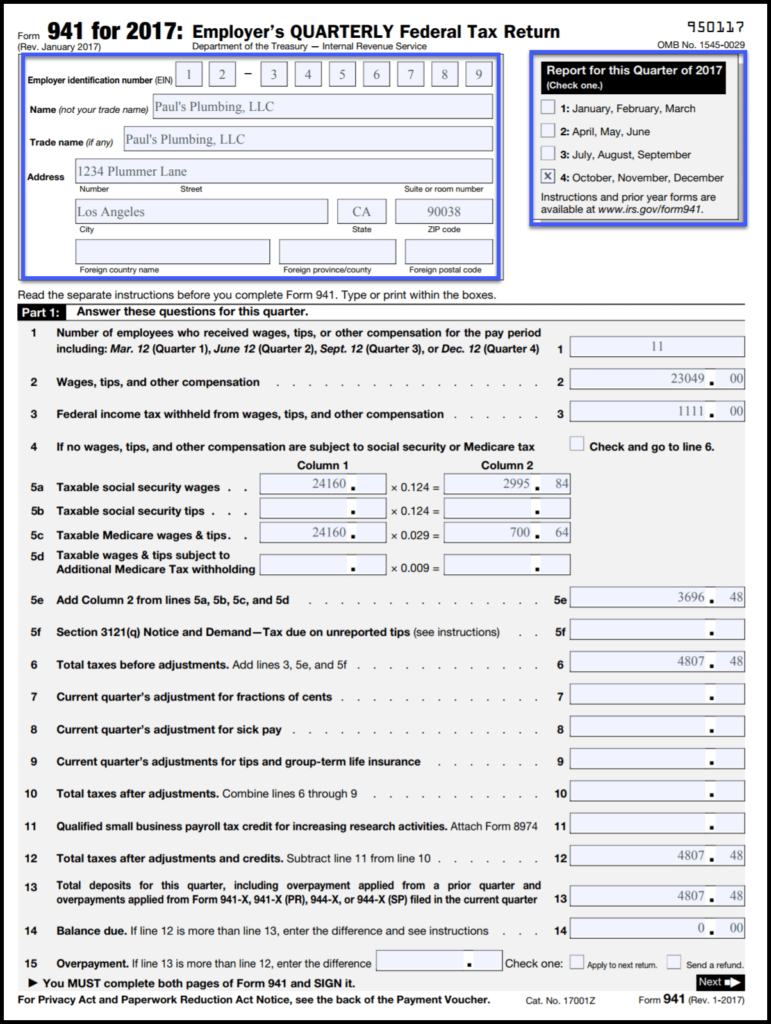

Data file-by days

If your business is required to do so frequently, you should be aware of the deadlines for filing the employee withholding form. The fifteenth day time of the 30 days once the end of the work schedule quarter will be the timeline for every quarter processing. Until you get a published notice from your Maryland Comptroller, you need to consistently file this particular type. You can even supply nonpayroll sums ahead of time and inside of 3 enterprise days soon after payroll, as a replacement. Should you be an agricultural or holiday filer, the due date to file nonpayroll quantities paid out in January is Wednesday, Feb . 17, or April 15.

The fifteenth in the calendar month using the stop of your work schedule quarter is the expected time for publishing Type L-1. If you pay semi-monthly, you have until the 15th of the month after the end of the calendar quarter to submit your quarterly return. Even if you failed to withhold any taxes in that quarter, you must continue to file the shape. You must document digitally in order to avoid penalties.

Needs

Employees should every year complete a Form W-4, also known as the staff member withholding type. The staff member have to signal the record and give it on their company. There are a few exclusive circumstances that should be in the develop. It needs to be noted about the type regardless of whether a staff member includes a spouse, another work, or possibly a freelancing income. Investing, passive income, and other types of earnings can also be probable for an individual. Any dependents can be shown with the staff. The complete volume of taxation that person owes may be diminished by these deductions.

Making use of Develop W-4, a worker can request their workplace to avoid withholding federal taxes. The employee should never have already been taxed around previous and should not expect simply being taxed in the current season. They must reapply by February 15 of the following year, although a worker who requests a withholding exemption may do so for the duration of a calendar year. The Internal Revenue Service might require a difficult backup in the kind from the personnel, according to their certain scenario.

Cases

It is possible to opt for the proper add up to deduct through your shell out by using an illustration staff withholding type. You can also point out any other cash flow or deductions you could have. These could lessen your total income tax responsibility. Use an on the web estimator or fill out the form you to ultimately estimation your deductions to ascertain the amount to withhold. You may find out more by using the IRS’s withholding calculator if you’re unclear of how much to withhold.

You fill in the W-4 kind with information regarding your withholding. The information you provide on the develop is used through your company to determine how much payroll taxation you must shell out. Your company concludes these amounts on your behalf. Wrongly accomplished types could result in substantial taxation fines and liabilities. Additionally, you will find the option of experiencing additional income taxes deducted from your wage. To stop faults, you ought to cautiously read through and comprehend the recommendations around the develop.